Internet Banking Savings Account S17

Savings Account With No PassBook.

Special Savings account holders enjoy a higher interest rate and even lower fees.

- Funds available on demand

- No withdrawal fees

- 1 free transactions at other branches where prior arrangements made, otherwise small charge

- Interest is tax-free up to $900 per year

1% pa1

interest rate

| Internet Banking Saving Account S17 | |

|---|---|

| Features | |

| Minimum balance | Nil |

| Service fee | Free |

| Maintenance fees | $2 per quarter |

| Over the counter withdraw fee | Free |

| Number of free withdrawals | Unlimited |

| Dormancy fee | $2.50 monthly charge when account inactive over 1 year until account becomes nil balance or become active again. |

| Minimum deposit | Nil |

| Minimum withdrawal | $10 |

| Withdrawal fees | Free |

| Automatic deductions | Nil |

| Interest Income | Calculated monthly, paid annually, only on balances more than $100. |

Automatic deduction from savings accounts

- Customer can authorise automatic deductions from saving accounts for TDB loan account.

- PPAs or deduction to accounts at BSP, ANZ or MBF Bank.

- No fee charged when insufficient funds in account to make the payments.

- Must always ensure that there is sufficient fund in the Savings Pass Book and Accounts.

1. No interest on balances below $200.00

Basic Passbook Saving Account S1

Our standard all-purpose savings account.

The Basic Passbook savings account enables you to earn a competitive rate of interest and provides a passbook for easy record keeping.

Funds available on demand

No withdrawal fees

Interest is tax-free up to $900 per year

1.00% pa1

interest rate

| Ngaue Saving Account S1 | |

|---|---|

| Features | |

| Minimum balance | na |

| Service fee | $1 per monthly |

| Maintenance fees | $2 per quarter |

| Over the counter withdraw fee | Free |

| Number of free withdrawals | na |

| Dormancy fee | $3.00 per month |

| Minimum deposit | $2 |

| Automatic deductions | na |

| Minimum deposit to open accounts | $10 |

| Deposit without passbook | $5 per transaction |

| Interest Income | Calculated monthly, paid annually, only on balances more than $100. |

Automatic deduction from savings accounts

- Customer can authorise automatic deductions from saving accounts for TDB loan account.

- PPAs or deduction to accounts at BSP, ANZ or MBF Bank.

- No fee charged when insufficient funds in account to make the payments.

- Must always ensure that there is sufficient fund in the Savings Pass Book and Accounts.

- There will be a Dormancy of $3.00 per mth for accounts not active more than 12 mths.

- Qtrly maintenance fees is now reduced to $2 per qtr

1. No interest on balances below $200.00

Fund to be on lent at 3%

Please click this button for more details

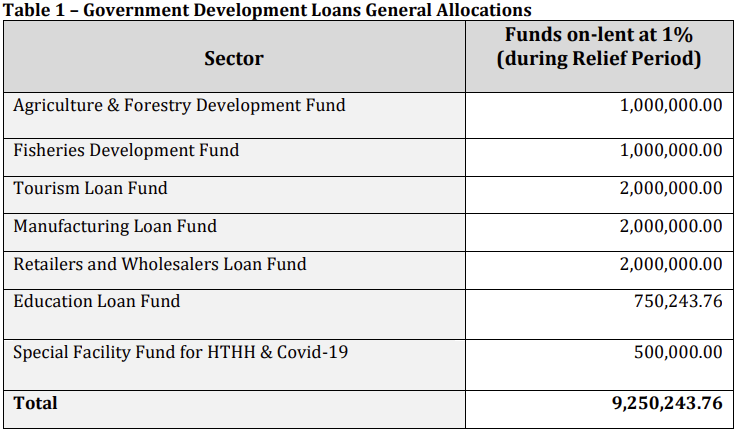

Government Development Loans at 1%

The Government of Tonga through the Ministry of Finance and Tonga Development Bank signed an extension of the Implementation Agreement of the Government Development Loans on 1st October 2020 for 5 years. However, due to the impact of the Hunga-Tonga-Hunga-Ha’apai Volcanic Eruption and Covid-19 pandemic, a variation agreement was signed (GOT-TDB Variation Agreement) on 29th April 2022 to be effective 1st May 2022. The following general allocations shall apply to the disbursement of the Government Development Loans at 1% as at 1st May 2022 for a relief period of 12 months. From 2 May 2023, all funds that were on-lent at 1% will be charged at 3% interest for the remainder of the period of each loan.

Women & Development

Empowering the women in our community

What is a Women & Development

To assist with the development and expansion of the role of women in business & general development in Tonga, finance is available for lending to income generating projects as well as social development projects. These projects are to be implemented and managed by women. Both women’s groups and individuals are eligible for funding.

For women’s groups, applications must be channelled through the women’s section of the Extension Division of MAF for perusal and recommendation.

Why go with us?

Tonga Development Bank’s Women & Development loan has:

- A history of successful women and development projects

- An allowance where any available assets can be used as security

- Minimum age of 18 years

From

8.50% pa

interest rate

| Women & Development | |

|---|---|

| Features | |

| Security | Any assets available |

| Term | 24 months |

| Repayment Percentage Salary Deduction | Normally by cash though Salary Deduction is preferable. |

| Fees | For salary deduction, normally 50% salary allowed for repayment of loan. 60% can be considered depending on total salary |

| Disbursement | Can be charged to account. Direct to supplier where necessary or according to agreed draw down schedule. |

| Rates | |

| CRR A | 8.50% pa |

| CRR B | 9.00% pa |

| CRR C | 9.50% pa |

Eligibility Guideline – Applicants

Applicants considered under this Sector should:

- Women’s groups must have an existing working relationship with the women’s section of the Extension Division of MAF.

- Be sound credit worthy individuals or groups, who have a good credit history in the Bank. These includes client with CRR of A, B, C1.

- If an existing borrower, the group or individual must be able to demonstrate success on the previous project before another application will be considered.

- Minimum age of any applicant is 18 years. e. Size loan <= $5,000. Loan above $5,000 can be considered

More Articles…

Page 6 of 10